do pastors pay taxes on their income

So in a way they have. 100s of Top Rated Local Professionals Waiting to Help You Today.

Yes pastors pay federal income tax.

. Federal Income Tax. Answer 1 of 9. Clergy must pay income taxes just like everyone else.

Search Do Clergy Pay Taxes. Get Results On Find Info. However if the speaking engagement is part of regular church service it would be considered part of the pastors main employment income for the church.

The IRS does not exempt pastors from paying taxes on their income just because they are a. 417 Earnings for Clergy. Answer Simple Questions About Your Life And We Do The Rest.

Unfortunately the rules for clergy income taxes can be especially confusing. Priests and Pastors pay income taxes on their salaries but are exempt from taxes on their parsonage allowance if it meets certain requirements. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld.

Ministers pastors and other members of the clergy are required to pay Federal Income tax on their salary. Ad Search Do Clergy Pay Taxes. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

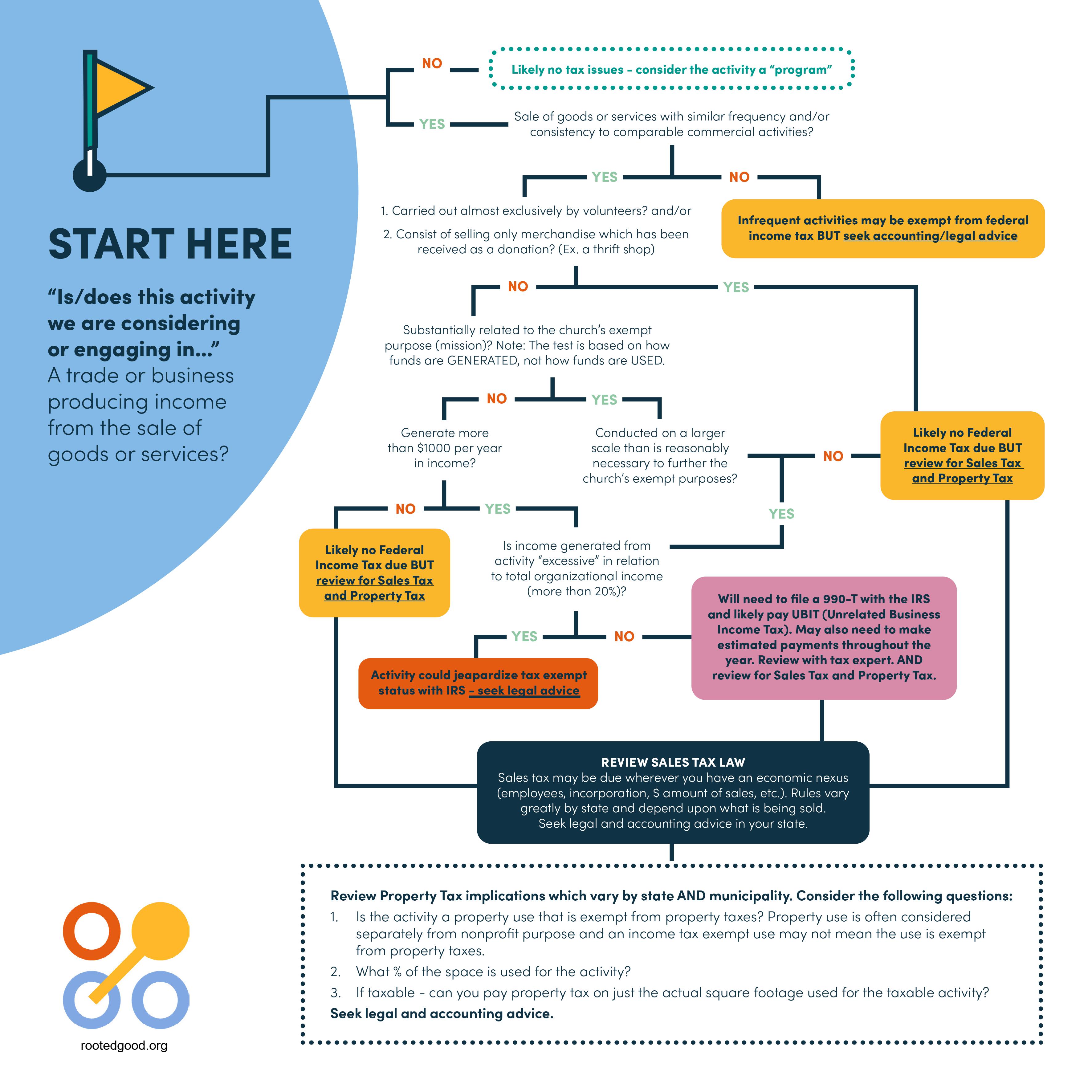

Section 107 of the Internal Revenue Code clearly allows only. While it is true that churches merely by the virtue of truly being churches enjoy tax-exempt status from federal corporate taxes that does not mean that churches do not pay taxes at all. Do pastors and priests pay taxes.

Ministers who own or rent their home do not pay federal income taxes on the amount of their compensation. Like the rest of us you pastors have to pay federal income tax. Answer 1 of 3.

The housing allowance is for pastorsministers only. According to the Internal Revenue Service IRS pastors provide ministerial services usually as common-law employees of a church organization denomination or sect. The church would provide a W-2 for.

Members of the Clergy. Not every staff member at the church can take this allowance. The popular notion that pastors do not pay taxes on their income is incorrect.

Answered as a US tax specialist and the spouse of a man who worked exclusively as a Presbyterian pastor for 13 years. They may designate a portion of their. A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or organization that.

Irwin Mcgraw Hill C The Mcgraw Hill Companies Inc 2000 Principles Of Taxation Chapter 4 Basic Maxims Of Income T Income Tax Mcgraw Hill Education Mcgraw Hill

Tax Prep Do You Know If You Have A Tax Lien On Your Property How To Find Out Tax Help Tax Prep

How To Set The Pastor S Salary And Benefits Leaders Church

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Equipping Pastors To Master Their Personal Finances Pastor Health Insurance Companies Finance

The Different Kinds Of Income A Pastor Can Have How The Irs Treats Them The Pastor S Wallet

Christian Principles For Managing Money

Your Pathway To Becoming An Enrolled Agent Enrolled Agent Tax Prep Checklist Continuing Education

Why Do Church Employees Pay Income Tax Quora

Pin On Affiliate Marketing For Bloggers

I M A Quadruple Threat I Can Go Geeky Dorky Nerdy And Now Wonky Cartoons 1980s 80 Cartoons Funny Comics

Our Church Is Making Money Or Thinking About It What About Taxes Faith And Leadership

Video Q A Is A Car Payment Taxable Income For A Pastor The Pastor S Wallet

Understanding Your Tax Forms 2016 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

How Pastors Can Claim The Earned Income Tax Credit The Pastor S Wallet

How To Read And Understand Your Form W 2 At Tax Time Tax Forms W2 Forms Tax

Picture Of A Hand Opening A Door With Blog Post Title 2020 Housing Allowance For Pastors What You Need To Know Housing Allowance Allowance Pastor

What Is A 1099 And Why Did I Get One Irs Tax Forms Tax Forms What Is A 1099